Glossary

Key terms and concepts for conducting research, insights & analytics.

Ad Concept Testing

Measures target-market consumers’ reactions to and/or attitudes about the underlying concept for an ad or advertising campaign before introducing it to the market. In a typical ad concept testing session, participants are exposed to short descriptions of the concept and ad copy, story boards, storyboards or animatics (animated storyboards), rather than fully produced ads. Participants may be asked a series of questions about the ad concept, such as whether it is relevant to their lifestyle, if it grabs their attention, if it gives a strong brand impression, etc.

Aided Awareness

Measured as a percentage, aided awareness is when respondents are only able to remember having seen something (e.g. a brand or an ad) after they have been shown some form of stimulus material.

This may or may not be part of the “Ladder” questioning technique. Many interviews or focus groups may start with asking respondents to list the brands they can think of in a particular category, followed by presenting the respondent with a list of brands and seeing which ones they recognize with prompting. When used with ads, this might involve asking if the respondent has seen ads for a particular brand, followed by showing them an ad and asking if they recognize it.

Synonyms: Prompted Awareness

Further reading:

Back Room

Traditional focus group research is conducted in situ, that is, through an organization’s own facilities or meeting place. In this context, the back room consists of a literal room in which researchers, clients and other stakeholders listen and observe as qualitative research is being conducted live. This room is traditionally hidden from the observed focus group through a one-way mirror. In online qualitative research, the ‘back room’ refers to the technology utilized to observe a live recorded interview, without being viewed by the participants. Multiple back room participants may chat to themselves in their own private text chat, and may send private messages to the moderator.

Learn more about the Discuss Backroom Chat feature.

Brand Market Research

Brand market research is a method in which researchers gain customer feedback and market insights to understand the customer perception of a brand. Branding refers to the public-facing representations of an organization and the associations that the public has with that organization as a result. Such representations include everything from a brand’s reputation, to visual identifiers (logos and graphic representations), media such as commercials and ads, and other public-facing representations. Insights professionals that conduct brand market research seek to better understand a brand’s visibility within a marketplace in order to identify how it measures up against its competitors and within an industry in general.

Read our latest post, “10 Ways to Improve Your Brand Perception with Customer Feedback” to learn more.

Consumer Confusion Study

A study that aims to measure the tendency of consumers to confuse the company that makes a particular brand with another company, or to confuse one brand with another. This is a popular research is used to measure brand affinity. The new mobile screen-share app integrated with the platform lets you see/observe your consumers experience brands elements in real-time while interviewing them through the Discuss.io platform. Researchers can take advantage of all of the features and benefits of the Discuss.io platform while watching the respondent’s mobile or tablet screens and seeing their faces – it’s a mobile experience game changer.

Consumer culture

A culture may be understood as a pattern of beliefs, values, meanings and customs shared by a group of people, often existing at an implicit or taken-for-granted level. Consumer culture suggests that consumption – the act of buying goods or services – is a cultural activity, one imbued with meaning and driven not just by practical or economic factors. Mapping and exploring the business implications of these cultural meanings is one of the principal functions of qualitative market research

Control Group

An experimental design involving groups of respondents. Neither group is measured before the experiment. During the experiment the control group is not subjected to the experimental variable. At the conclusion of the experiment, both groups are measured. The control group’s measurement is deducted from the other group’s measurement. This can be easily coordinated using Discuss.io’s platform new feature called the An in-depth conversation with interviewers at the conclusion of a study. The interviewer plays back his/her impressions of the respondent’s feelings about specific questions. This technique is often used immediately after a pre-test of a questionnaire. The information provides the researcher with insights necessary to revise or refine the final questionnaire and/or future studies.respondent hub. The respondent hub allows you to hold sessions with respondents at ease for such experiments.

Diary Panel

A group of respondents that are asked to keep journals on their buying, watching, or listening habits over a period of time. We can use a set of respondents for a prolonged period of time to record their impressions of usage of a product during agile marketing research cycles.

Sessions of the particular respondents can be saved for use later in the archived section of the Discuss.io Platform which can be used for the purpose of a diary panel.

See also: Highlight reels

Dyads

Dyads involve two people in an interview. Dyads can be structured in two ways. The first is to recruit two participants who may know each other (husband and wife; parent and child; two friends or co-workers). These are referred to as Known Pairs, and are the go-to choice if working with children or younger participants. The other option is recruiting strangers who have been screened for sharing similar behaviors and interests OR a conflict pair. When selecting a conflict pair, the researcher is trying to dramatize the differences between the two. This is useful when looking at loyal users of two different brands or products to learn more about the reasons behind the brand loyalty, and where its weaknesses are.

Ethnographic Market Research

Ethnography is a research method central to knowing the world from the standpoint of its social relations. It is a qualitative research method predicated on the diversity of culture at home (wherever that may be) and abroad. Ethnography involves hands-on, on-the-scene learning — and it is relevant wherever people are relevant. Ethnography is the primary method of social and cultural anthropology, but it is integral to the social sciences and humanities generally, and draws its methods from many quarters, including the natural sciences.

Focus Group

Also known as “group interviews”, focus group research gathers a small but demographically similar group of people, to study their perceptions, opinions, beliefs, attitudes and reactions. This qualitative research method collects data, through interactive and directed discussions, facilitated by a skilled moderator. Focus groups are a staple of market research, and it is frequently used by marketers to learn about and test an idea, concept advertisement, product, packaging or service.

Focus groups make use of group interaction to explore and clarify the beliefs, opinions and views of focus group participants. This interactivity allows researchers to gain data and insights from multiple members simultaneously, making it a far more cost effective method for qualitative market research than one-on-one in-depth interviews.

Highlight Reel

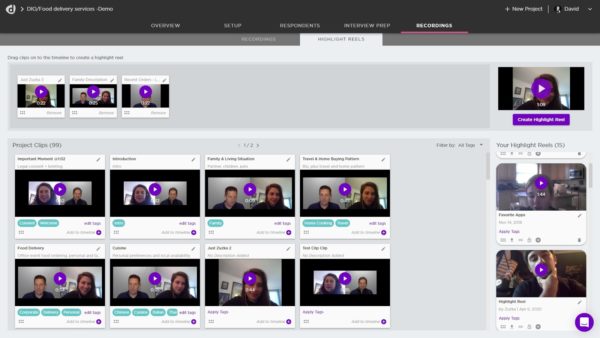

Highlight reels are the edited down version of market research interviews, showing just the highlights and most pertinent moments from the entire process. They may be from multiple interviews in the same project, and can be edited to show just the person speaking, rather than the usual split-screen view. Highlight reels are often compelling, using the biggest strengths of qualitative market research, allowing stakeholders to be shown not just the words, but the manner in which they were delivered, with vocal emphasis, body language, and emotion. While traditional video editing is difficult, slow, cumbersome, and requires training, a paid software license, a powerful computer, and local storage, Discuss.io’s video editor is included free with all projects, and is done easily, and efficiently in the web browser, using a simple drag-and-drop interface.

- See also: Save Moment

Highlight reel creation using the Discuss.io browser-based platform is quick and easy.

In-Depth Interview (IDI)

An In-Depth Interview, or IDI, is a type of qualitative research involving a personal interview with a single respondent. These are conducted one on one (1:1), although there may be hidden observers (as Discuss.io supports). These should be conducted by a highly skilled interviewer. The purpose of in-depth interviews is to understand the underlying motivations, beliefs, attitudes, and feelings of respondents on a particular subject or brand. These are in contrast to focus groups, which have multiple respondents in a group, along with one moderator, who is facilitating a group discussion.

Incentive

Participants are financially rewarded for giving up their time, usually over an hour, and providing honest information about their feelings, motivations, beliefs, attitudes, and behavior. Incentives are usually digital gift cards or pre-paid cash cards, in local currency. In traditional market research these were managed and tracked manually by external systems. Discuss.io integrates this into our platform, automating this task for you, whether participants recruited through us, or if they were imported into our system (DIY Recruiting).

Market Research

The term “market research,” also referred to as “MR” or “MRX,” describes a method of research used by organizations to understand their customers, users and prospective audiences, thereby leading to greater market understanding. Market research has historically been conducted in person through ‘field reports’ consisting of focus groups, panel discussions, and in-depth interviews (read more to understand the difference between focus groups and interviews). However, modern market research, now more commonly referred to as “insights and analytics” is increasingly held online and with added enhancements such as machine learning transcription services and automated insight extraction capabilities.

To learn more about Discuss insights features, click here.

Panel Recruiting

The process of finding respondents for research. This process may be handled by the researchers using a variety of means, our outsourced to specialist companies who have their own pools of people they can draw on, or recruit fresh. Recruits are selected based on defined demographic characteristics, along with other requirements, such as being a customer of a product category, or the person who makes grocery purchase decisions in their household.

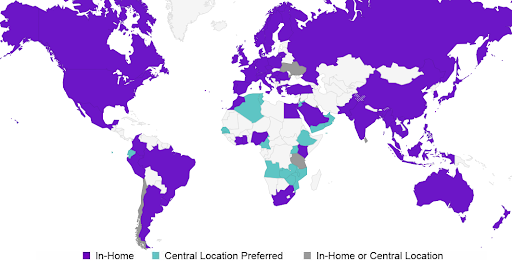

The quality of market research comes down to the participants you recruit. A large and diverse pool of existing recruits is essential. Discuss.io is the market leader offering pools and fresh recruiting in over 100 countries, worldwide. Discuss.io recruits are also of higher quality. We score recruits for their level of talkativeness, and by running a tech check, to rate their computer and internet speed for video chat.

Qualitative Interview

Qualitative interviews are the most effective form of qualitative research (in which respondents are asked open-ended questions, as against selecting from a short list of predefined answers). Qualitative interviews give researchers the opportunity to ask follow-up probing questions of participants, and encourage better, longer and more honest answers. As a result, insights gleamed from qualitative interviews are richer than qualitative surveys. Discuss.io’s recorded qualitative interviews also result in more compelling insights through the use of video clips and highlight reels that can be presented to stakeholders, along with the findings.

Research design

The essential parameters of a research project, including factors such as its basic approach (qualitative, quantitative or some combination); the sample or target to be interviewed or observed; numbers of interviews or observations; research locations; questionnaire or discussion outline; tasks and materials to be introduced; and so on.

There are always many possible ways to address a specific research problem and the research design – the way the researcher formulates the problem and designs a project to address the client’s issues – is a key part of how a research proposal is evaluated.

Respondent

An individual that takes part in a market research project. This is increasingly replaced by the term ‘participant’, as researchers and clients recognize the value of a more collaborative interviewing relationship — that is, the research subject is no longer regarded as a passive object to be studied, being kept in the dark about the research and its objectives and simply ‘responding,’ but as a valued partner in an exploratory process.

Rigor in Research

A study’s rigor is what primarily differentiates what is research and what is not research. The strength of a study’s processes and findings, ‘rigor’ is a catch-all term that denotes quality and reliability within all methods of research. Measuring rigor depends on research methodology and type. Rigorous quantitative research, for instance, considers specificity, accuracy, and thoroughness. Likewise, qualitative research also has its own criteria.

To learn more, read our post, “Rigor in Qualitative Research Methods.”

Save Moment

Important moments may be flagged by observers (and moderators) both during the live interview, and while watching recordings. These moments are automatically flagged on the video timeline, and automatically create a short 30 second clip (15 seconds before and after the moment). The start and end of these clips can then easily be changed. The created clips may be tagged, and arranged into highlight reels.

Stimulus Material

Material of a visual, verbal and/or auditory nature used to communicate certain ideas to enable them to be researched, or to stimulate discussion of relevant topics.

Triads

Triads involve three participants who may or may not know one another. Triads offer some of the advantages of focus groups and in-depth interviews in that the moderator can hone in on topics/subjects while also having a diversity of opinion. Triads also offer researchers opportunities to test how group dynamics can influence purchasing behaviors. For instance, you can recruit two participants who are brand loyal to one product and one participant who is brand loyal to another. The moderator can then create situations that would test the strength of brand loyalty and see how the dynamic shifts between the three participants. Triangulation within the group can sometimes reveal areas for companies to focus on when creating marketing plans.

Usability Testing

Usability Testing is the assessment of a product or service’s effectiveness and efficiency as viewed by a specified group of users. It is customer-focused and based upon actual product/service trial. Usability Testing is most frequently employed with Web site testing, but is also used for myriad other applications such as assembly instructions, packaging use, product preparation, and other consumer-based actions. Usability Testing is a technique for ensuring that the intended users of a system can carry out the intended tasks. During a Usability Test, feedback is gathered to improve product design. The immediate result of a Usability Test is a list of specific recommendations as to how to improve the product.